Your becomes smarter, nowpowered by Data

We develop models using the best data and comprehensive analytics. FindBelay leverages your enterprise data and, with the FindBelay Platform, safely unlocks the full value of AI

The future of insurance starts here

FindBelay is an insurtech company powered by artificial intelligence (AI) risk management systems.

It enables personalized and transparent insurance solutions for your insurance company, agency, or marketplace, providing world class AI models and internal platform that can be integrated to any insurance business around the world.

Seamless Integration:

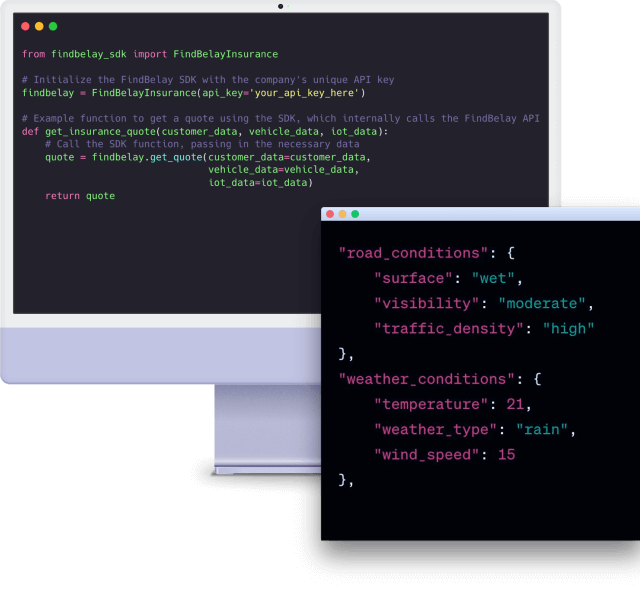

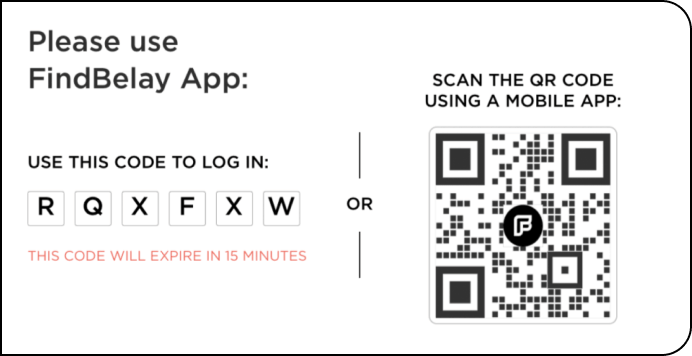

FindBelay can provide insurance companies, agencies, marketplaces, and other insurance market participants with SDKs or APIs, which they can integrate directly into their existing digital interfaces, such as websites or mobile applications. This means that the insurance company's customers will not directly transition to FindBelay, but all interactions will occur within their familiar environment.

FindBelay Platform and API access

For Insurance customers:

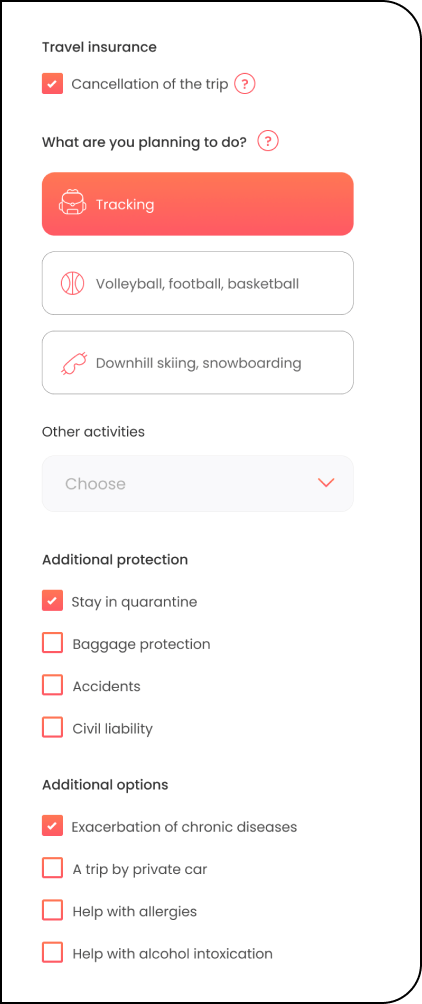

Using our widgets and integration, we make it easy for your customers to compare and customize insurance quotes and buy personalized insurance policies.

1

Place Your Logo Here

2

Insert Your Brand Name

3

Embed Your Custom Widget Here

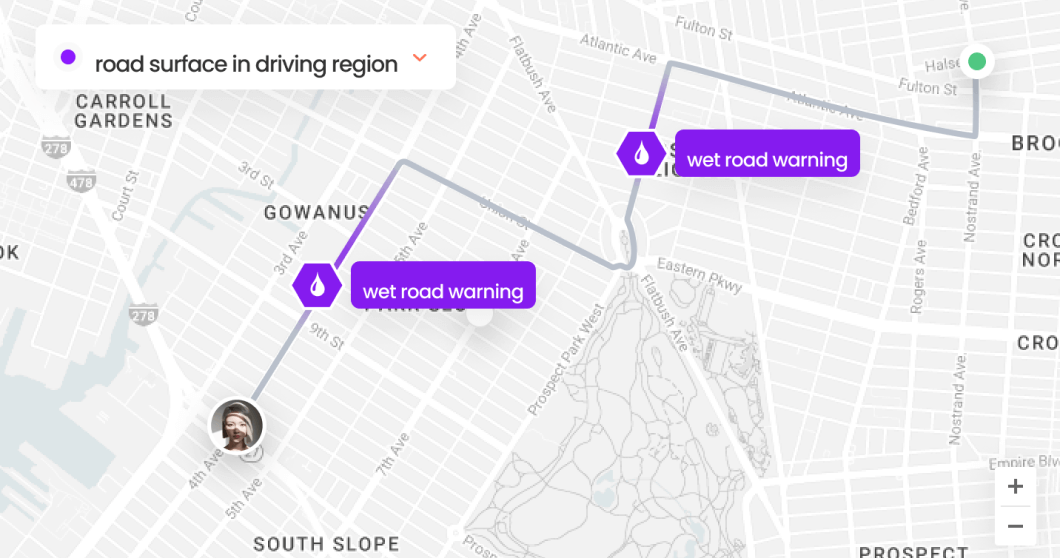

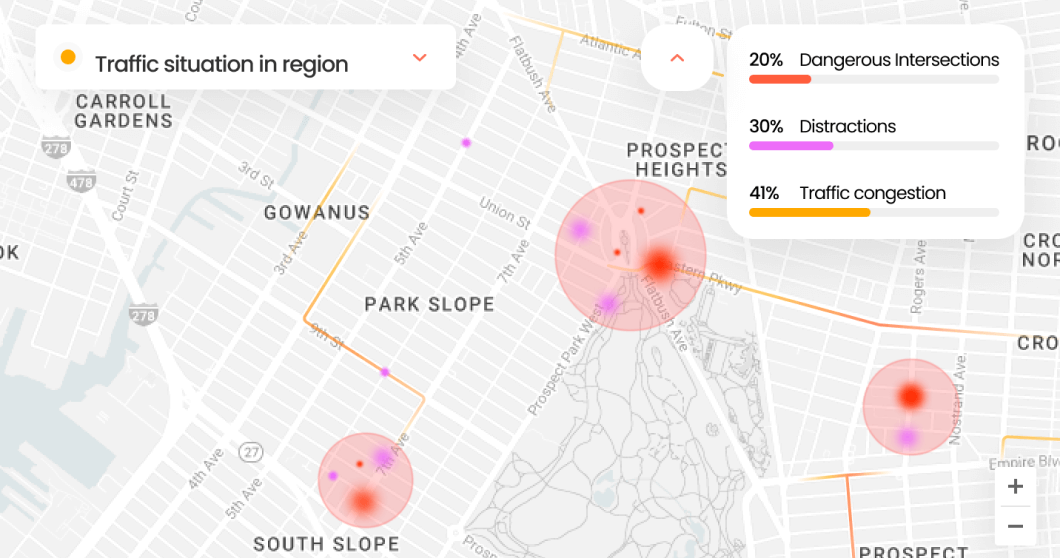

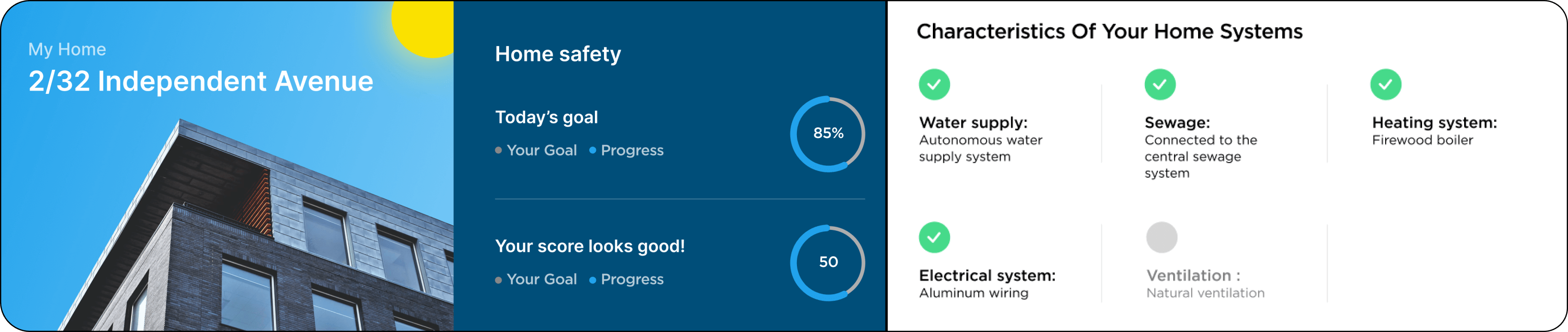

We allow you to leverage and integrate the power of our ML models, which enable you to assess your customers' risks. For instance, in auto insurance, this involves a 'test drive' feature that allows us to evaluate driving behavior and understand all potential risks, so you can offer them the best policy.

1

Integrate your custom widget for customer-tailored risk assessments and insurance quotes

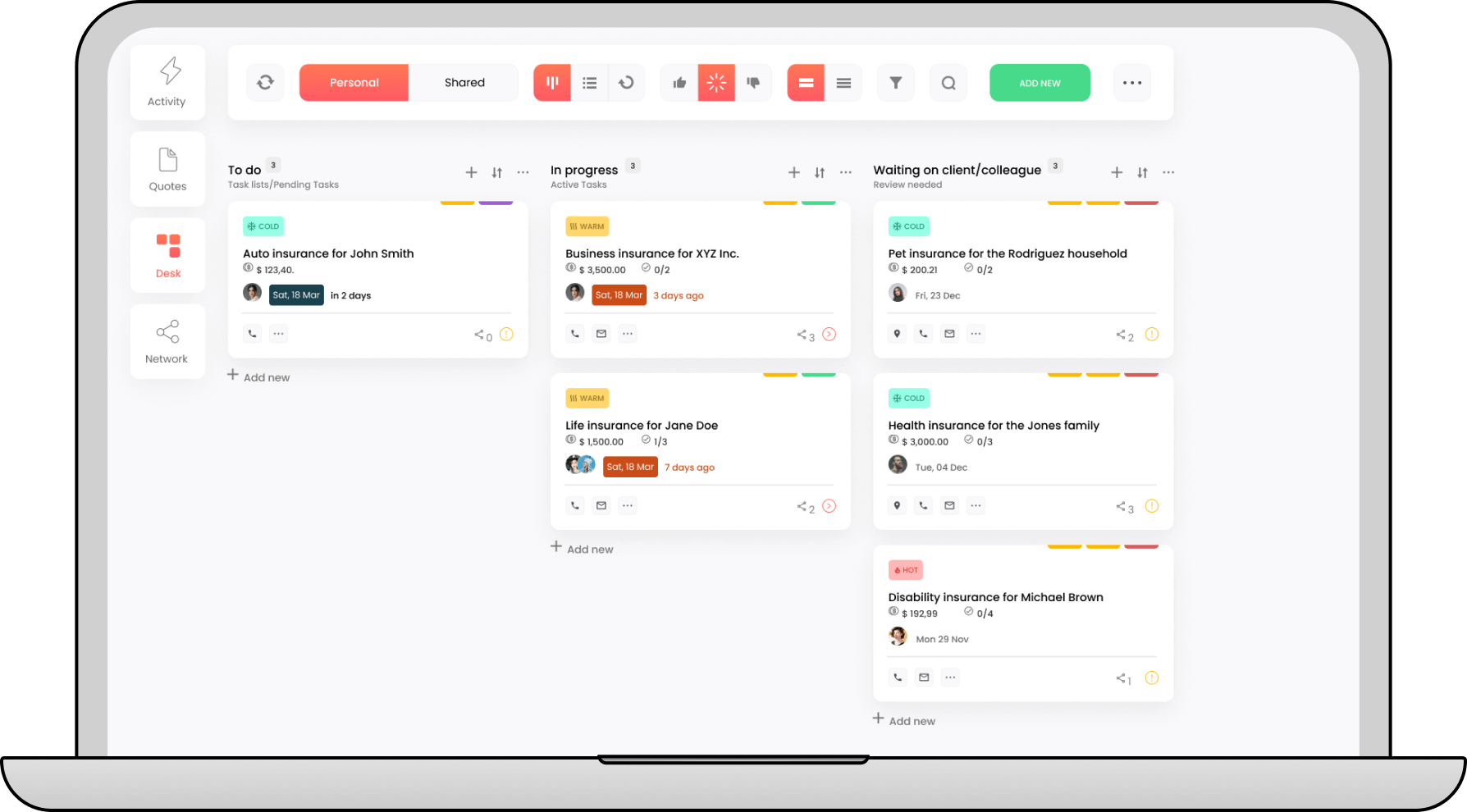

For Insurance professionals:

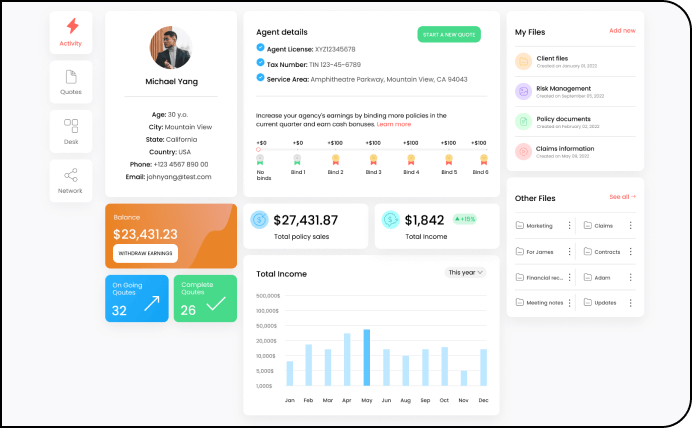

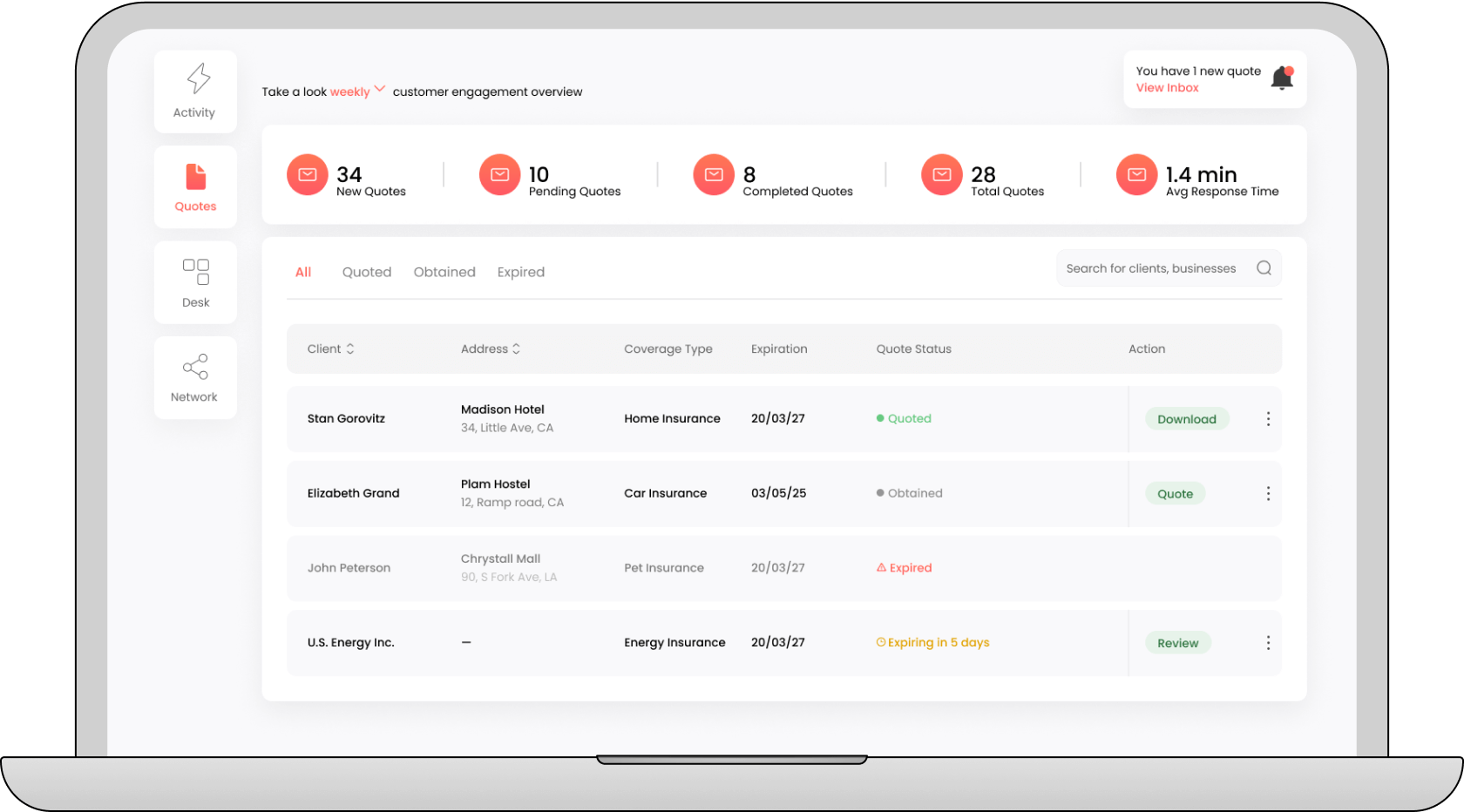

Manage all your clients in one place by connecting your insurance business to us. Create smart quotes online and gain full access to an interactive dashboard built specifically for industry professionals.

1

Personalized dashboard with comprehensive analytics for your insurance nerds.

2

Track all your quotes and clients in one place with complete and detailed information

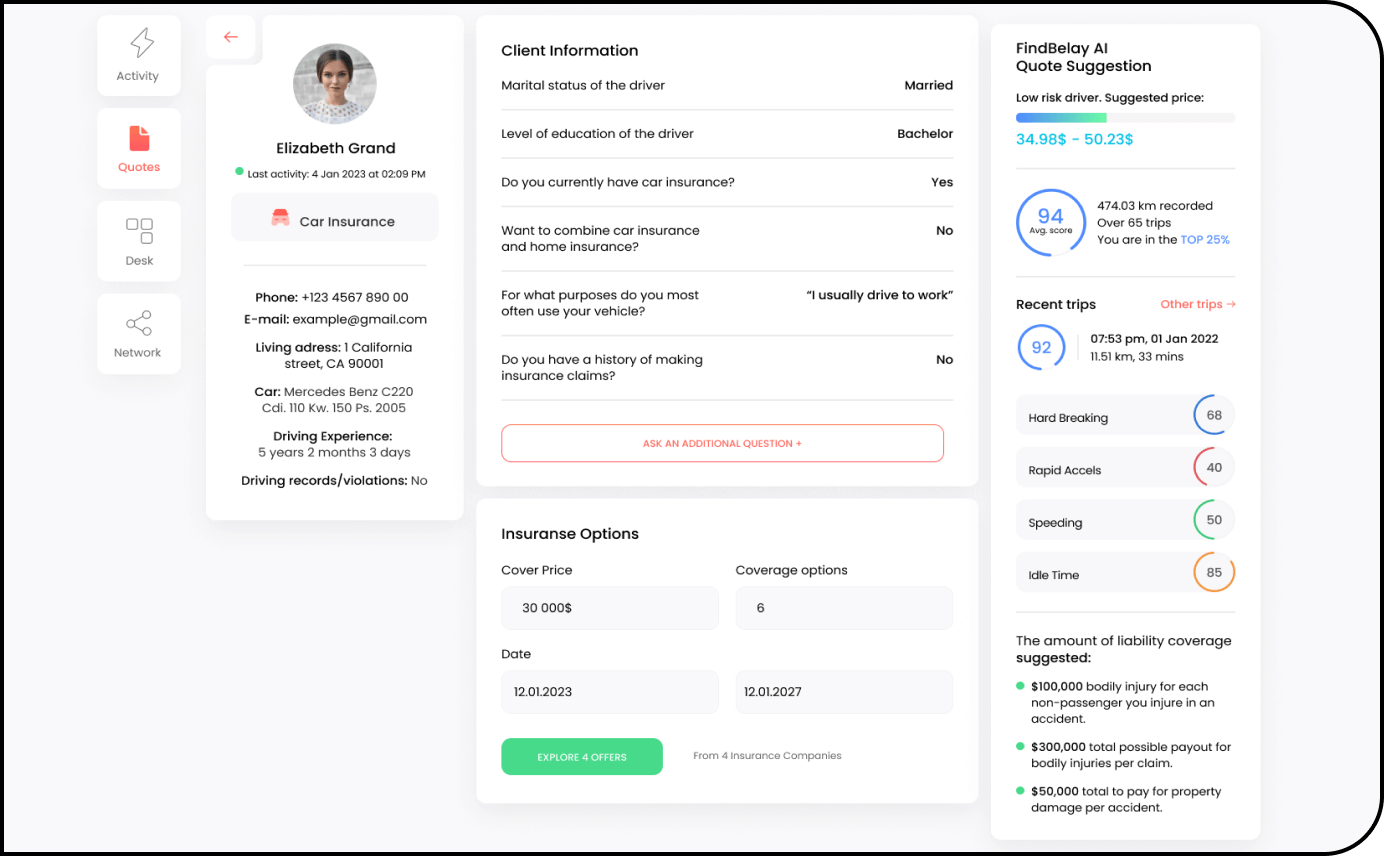

Generate and request personalized risk test assessments using FindBelay AI and receive comprehensive report and insights before finalizing insurance for your clients.

3

Tools that allow you to always keep your business under full control.

4

An intuitive insurance dashboard presenting client details, risk assessment, and policy options for streamlined decision-making.

Interested?

Talk to AI expert

Talk to AI expert

FindBelay is open to collaboration with generative AI companies, U.S. government agencies, enterprises, and startups worldwide. FindBelay works with Generative AI Companies, U.S. Government Agencies, Enterprises & Startups

FindBelay AI Quote Engine

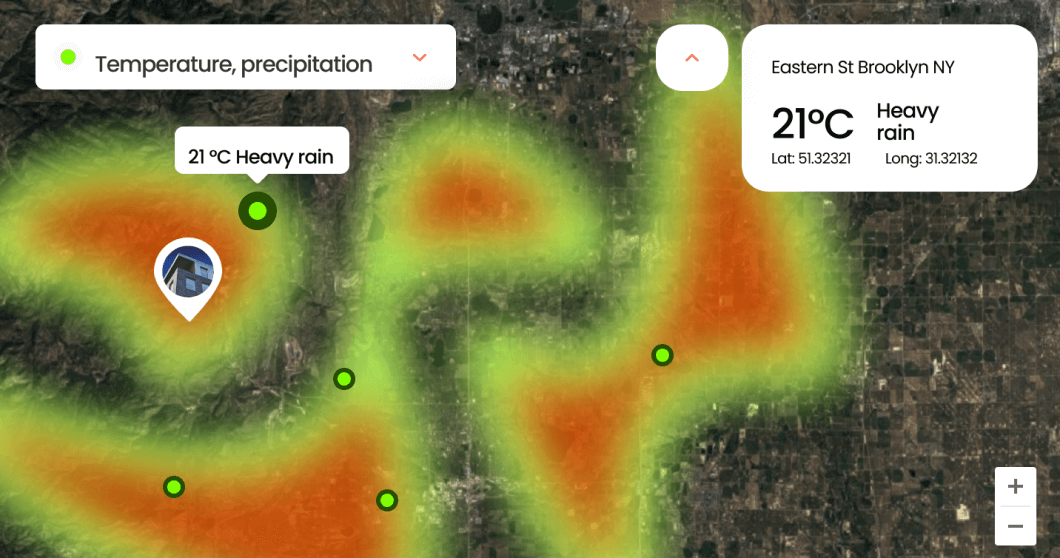

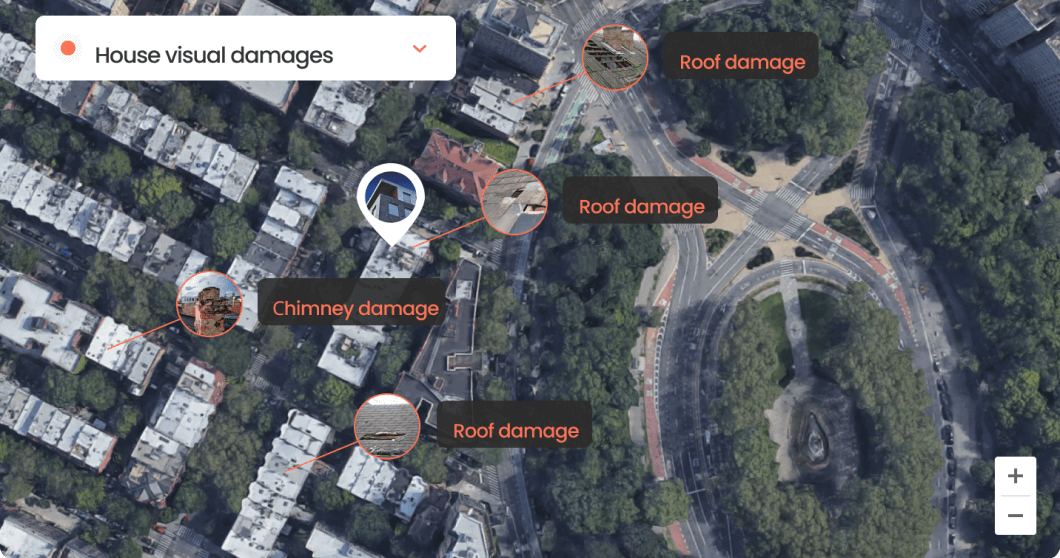

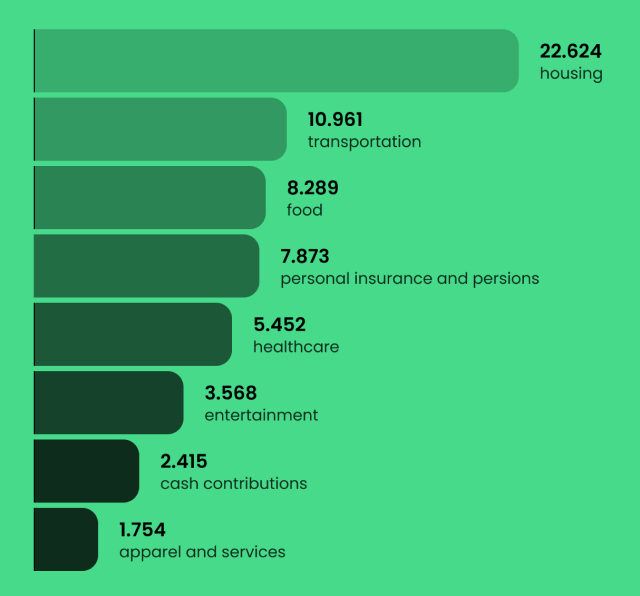

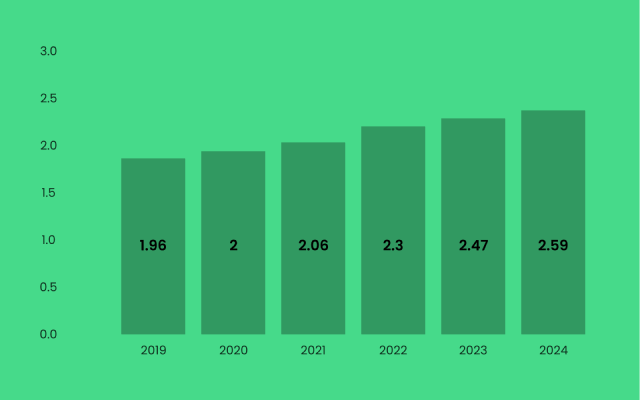

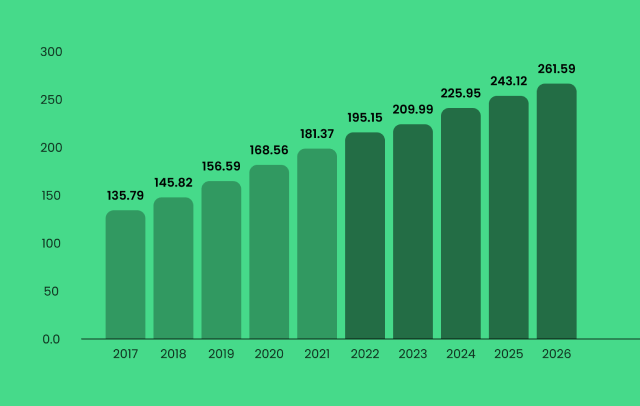

At FindBelay, we use an AI quote engine to provide more accurate and personalized insurance quotes.

By analyzing information about an individual's personal property, as well as their lifestyle, behavior, and decisions, and comparing it with global data, our algorithms take into account a broader range of factors to assess the user's risk profile more accurately. This enables us to offer more customized insurance coverage options and assist your consumers in finding a policy that matches their specific needs and budget.

There is a better way to deal with insurance.

Let’s talk

Feel free to get in touch by filling out the form below.